June 2015 Newsletter

The SA State Budget was released mid-June. Finally, a Budget with some courageous tax reform measures that will yield genuine relief to business. Plus we remind you of a couple of things that might be worth looking at before the end of the financial year.

In this edition...

Long-time readers of our newsletters will know that one of our recurring laments is the lack of courageous tax reform by Governments at all levels. So we were left picking ourselves up off the floor following the State Government's budget announcement last week. Finally, something to celebrate - a bold set of initiatives from a Government willing to risk a hit to revenue in order to cut red tape and stimulate the economy!

Long-time readers of our newsletters will know that one of our recurring laments is the lack of courageous tax reform by Governments at all levels. So we were left picking ourselves up off the floor following the State Government's budget announcement last week. Finally, something to celebrate - a bold set of initiatives from a Government willing to risk a hit to revenue in order to cut red tape and stimulate the economy!

Up until this most recent announcement, State Budgets have always been - to be frank - a bit of a yawn. We would rarely give any coverage to one. To some extent, this is understandable. In our more generous moments we might even have some sympathy for all State Governments, having to rely on a grab-bag of regressive and miscellaneous taxes to make ends meet. State Budgets are usually cautious in nature, and mostly involve tinkering around the edges - a threshold adjustment here, a temporary rebate there.

Further, in recent years almost all Government budgets, both Federal and State, and on both sides of politics, tend to talk big when it comes to reform while at best initiating yet another review of the system. These reviews give the impression of serious consideration to the problem whilst taking years to complete, at which time most of their ultimate recommendations are ignored. In the end, the conclusions are usually ones we're all well aware of when we set out - there are fundamental compliance burdens and regressive taxes across all levels of Government, which stifle business success and prosperity. But the fear of a potential risk to revenue has always crippled any prospect of radical reform. Until now.

The most recent State Budget announced some of the most progressive tax initiatives seen in decades. Indeed, CPA Australia have called it "the most comprehensive package of tax reforms in South Australia’s history, valued at around $670 million over the next four years".

The highlights for business include:

-

The abolition of ‘share duty’ (stamp duty on transfer of shares in private companies, and transfer of units in unit trusts). This is effective immediately. Note, however, that there will still be duty where the company or trust owns real estate – so you still can’t avoid conveyance duty simply by holding property in a company or trust and transferring the underlying shares or units. The savings for business here are potentially significant. Not only has duty been payable when a business is sold between two parties operating at arm's length, but it has also been invoked in many cases when a business is restructured. This has often been an impediment to businesses that grow and find that their initial structure is no longer appropriate.

-

The abolition of stamp duty on transfers of ‘non-real property’. Again, this is effective immediately. Non-real property excludes land and buildings, but includes many items typically involved in the sale of a business – goodwill, plant and equipment, debtors, and intellectual property.

-

The phasing out of conveyance duty on the transfer of non-residential, non-primary production real property. Broadly speaking, this refers to duty on ‘commercial property’ – commonly factories, offices, shops. This will take place over three years, with equal annual reductions starting 1st July 2016 and resulting in total abolition by 1st July 2018. In dollar terms, this will have a significant impact – stamp duty on a $1m commercial property is currently $48,830, for example.

It’s important to note that the critical date here when examining any particular transaction is the date of ‘execution of the instrument’ – that is, the date the contract is signed – so for contracts or transfer documents signed before 18th June the old rules will still apply.

It’s not just the dollars of stamp duty saved which is a benefit – in many cases the cost of the ‘red tape’ involved with the compliance requirements for all of the above has also been significant (sometimes more than the actual duty payable), with the requirement to submit paperwork and justification of values for stamping. This involved a great deal of time and expense for what often amounted to a relatively paltry amount of stamp duty.

Keep in mind that although the above is a welcome removal of a layer of cost and complexity, it doesn’t mean you now have total freedom with respect to the transfer of assets between entities, as the Commonwealth Government is still there waiting with Capital Gains Tax on many such transfers. So sound advice before restructuring is still critical for avoiding costly mistakes.

We applaud any side of Government willing to take the very real issue of tax reform for business seriously. The current Federal Government, when elected, declared Australia 'open for business'. Since that time however, we have really only seen yet more reports and inquiries commissioned. In response to the release of one of these reports, we said in a previous issue that with "...any reform, the risk of a short-term revenue hit is real. But of course better and more productive business ultimately leads to higher profits, which will in turn result in higher tax receipts. Until a Government is brave enough to take a risk on wholesale change, we suspect the outcome here will simply be more of the same."

That was an observation steeped in resignation. If the past was any indication, the future didn't hold much hope for change. The SA State Government has surprised many, including ourselves, by taking a 'nothing to lose, everything to gain' approach to stimulating economic activity through business. Many of these changes were foreshadowed at the time of the introduction of the GST some 15 years ago, and have been in the discussion phase ever since, with State Governments ultimately reticent to roll the dice. It doesn't address all of the impediments to business growth at a State level, the most obvious being Payroll Tax (although an extension of the Small Business Payroll Tax Rebate was announced, which is better than nothing). It is however an exceptional and welcome start.

We're pleased and encouraged to see a Government finally step up to the plate and take a chance on allowing business to be the driver of economic growth, and hope that it serves as a clarion call for real reform at the Federal level.

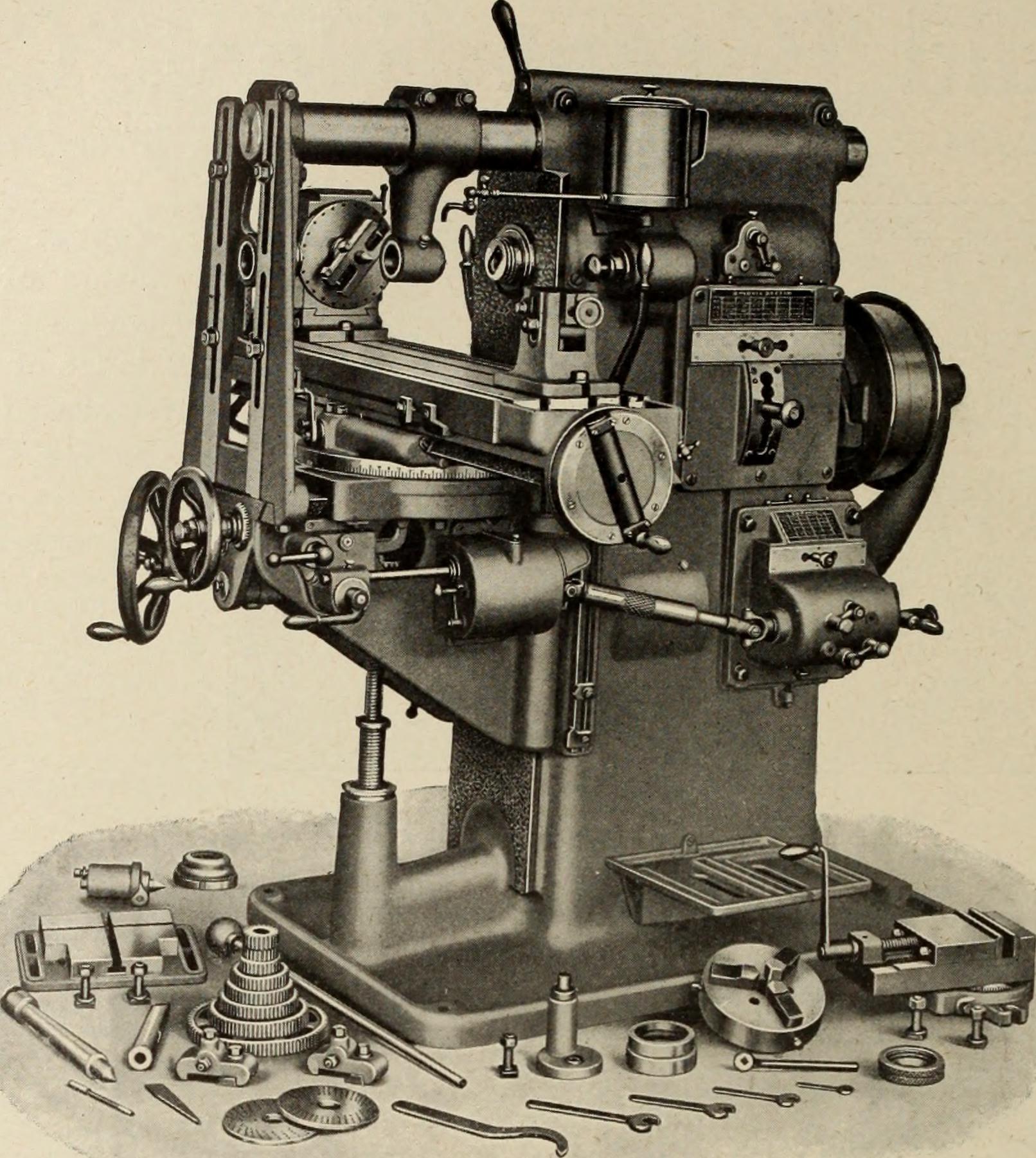

Before the end of the financial year, we usually like to list a few things you can do to reduce your tax bill before 30th June. With just a few days to go, one of the best things a small business can do is to take advantage of the recently announced $20,000 instant asset write-off.

Before the end of the financial year, we usually like to list a few things you can do to reduce your tax bill before 30th June. With just a few days to go, one of the best things a small business can do is to take advantage of the recently announced $20,000 instant asset write-off.

The Federal Budget this year announced an immediate increase to the limit below which an asset can be written off in full in a single year for tax purposes. This applies only to small businesses (those with turnover below $2 million), and is effective from Budget night, 12th May 2015 until 30th June 2017.

Assets such as equipment, motor vehicles and so on must normally be depreciated for accounting and tax purposes. This means that while you do ultimately get a deduction for the full cost of the asset, it is spread over a few years, based on the useful life of the asset.

With this increase, assets with a value of less than $20,000 purchased by a small business can now be claimed as an immediate deduction in the year of purchase. The previous limit was $1,000.

The advantage is purely one of timing, however being able to claim the full value of an asset in a single year can result in a significant cash flow injection by bringing forward a reduction in tax payable.

If you're a small business looking for a way to reduce the amount of tax you'll have to pay this year, and are in need of new equipment costing less than $20,000, buying it before 30th June (and having it ready for use) will make a big dent in your tax bill. Note too that the limit is per asset, so multiple purchases will multiply the effect.

This is really only good news though for those who were planning on buying equipment anyway. The effect really is an immediate discount on the cost of an asset, not a direct inflow of cash. If (say) your average rate of tax is 30%, you're still up for 70% of the cost, so there's no point buying equipment you don't need just to get the discount.

For those using the log book method for claiming motor vehicle expenses, we just wanted to remind you that a requirement of using this method is that you record your odometer reading on 30th June. You need to do this each year, even if you're not in the process of recording the log book itself. If you don't make a record of this reading, technically your claim will be invalid.

For those using the log book method for claiming motor vehicle expenses, we just wanted to remind you that a requirement of using this method is that you record your odometer reading on 30th June. You need to do this each year, even if you're not in the process of recording the log book itself. If you don't make a record of this reading, technically your claim will be invalid.

This seems like a good time to provide a more general reminder about the log book requirements as well. A common misconception is that once you have recorded your 12 week log book, that's the end of the matter and you simply claim your car expenses at the resulting business percentage in perpetuity. This isn't the case.

Aside from the need to record your odometer reading, you must keep a new log book every five years. So, if you use the log book method for claiming car expenses it would be wise to check when you last filled in a log book and if necessary, start a new one prior to 30th June.

It's also worth noting that once you have recorded your log book and worked out your business percentage, this is only to be used as a guide in determining your claim.

If in one year you undertake a significant amount of extra business travel (for example, a few interstate trips that were not included in your original log book), you can increase your business use percentage without keeping another log book.

Likewise, however, if you have reason to believe that you may have covered significantly less distance for business purposes during a particular year (for example, you have an extended holiday or illness), you are required to reduce your claim, even if you have a valid log book that shows a higher percentage.

As always, if you have any questions about these requirements, please give us a call. In the meantime though, if you're using the log book method to make your claim for car expenses, don't forget to record that 30th June odometer reading!

Download PDF Newsletter

Download PDF Newsletter