December 2019 Newsletter

Land Tax takes centre stage with the State Government securing passage of its controversial changes through Parliament, and we look (again) at the best way to make a tax effective Christmas gesture for your team.

Plus, read below for our Christmas closure times.

In this edition...

.jpg?width=200&height=151) When Land Tax changes were first proposed in the State Budget back in June, there was an understandable avalanche of backlash from property owners over the amount of additional Land Tax that could be due, particularly as a result of the new aggregation provisions. After much negotiation and compromise, the South Australian State Government's controversial Land Tax changes have now been passed through Parliament. Despite many amendments being made from the original proposal, it remains difficult to assess the overall impact of the changes and what they will mean for property owners as a whole.

When Land Tax changes were first proposed in the State Budget back in June, there was an understandable avalanche of backlash from property owners over the amount of additional Land Tax that could be due, particularly as a result of the new aggregation provisions. After much negotiation and compromise, the South Australian State Government's controversial Land Tax changes have now been passed through Parliament. Despite many amendments being made from the original proposal, it remains difficult to assess the overall impact of the changes and what they will mean for property owners as a whole.

It's been interesting to observe the extent to which the State Government has watered down the original Budget proposals since they were first mooted back in June, as much to appease lobby groups as cross-benchers, in order to secure passage of the changes. One issue the Government remained intransigent on however was that of aggregating multiple property holdings, and it ultimately managed to retain that aspect of the proposal in the final form of the legislation.

If we were to be writing Land Tax legislation today from scratch, it would probably not be unreasonable to assume that it would include some form of grouping arrangements. It has always been a somewhat peculiar loophole of our Land Tax regime that with some simple structuring, a person could avoid an obligation for Land Tax while still owning multiple properties. This is especially the case when so many other State and Federal tax regimes include aggregation across multiple entities in some form or another. In one sense, it's probably worth taking a moment to be grateful that the opportunity has existed for so long without any correction.

However the abrupt manner in which the proposal was to be implemented, without any grandfathering and ultimately in a retrospective manner (since structures were created and properties purchased with the existing system in mind), virtually ensured that despite the promise of 'reform', many landowners would be hit with a significant additional tax bill - in the order of many thousands of dollars in some cases.

Subsequent negotiations led to a number of compromises, including rate reductions and changes to thresholds. In addition, there are a number of concessions provided, including a $25 million transition fund to help those hit by higher tax bills as a result of aggregation (which will run for three years, although the details are scarce).

The rates

The table below shows both the existing thresholds and rates, and the new rates that will come into effect from 1st July 2020. For those who have a single property that is subject to Land Tax, it's pretty clear that you can expect a significant reduction in your Land Tax bill from next year, both from the higher thresholds and the lower rates.

Note: For simplicity, the rates are shown without any additional detail. However it should be noted that the rates are marginal and as such, only apply to the amount of the site value that exceeds each threshold amount. For example, if a property is valued at $1,500,000, nothing is payable on the first $450,000 while the highest rate of $2.40 per $100 only applies to the top $150,000 of the site value.

These rates are considerably lower, and take effect much sooner, than the original Budget proposal.

By way of a simple example, for a property valued at $2,000,000, the current total Land Tax Payable would be $39,070. From 1st July 2020, the total payable will be $26,452.50. That's a saving of $12,617.50.

What's more, the rates and thresholds will be adjusted further. From the 2022-23 financial year, the $1.25 rate will drop to $1.00, while the top threshold for the $2.40 rate will increase to $2 million. This will result in a further saving of $3,457.50 on a property valued at $2 million.

On the face of it, the reduction in rates looks like a big win for property owners, and the relief is certainly welcome. But all of this improvement comes at the cost of aggregation and changes to the way trusts are taxed.

Aggregation

Aggregation effectively looks through various legal structures and assesses total Land Tax on affected property owned by related parties. Essentially what this means is that from 1st July 2020 it will be more difficult for a property owner to reduce or eliminate Land Tax by purchasing property in a different entity or ownership interest. Instead, the total property owned across certain related entities will be aggregated, and Land Tax assessed on the total holding, with only one set of thresholds applicable to the total.

This is a big change. Further, because there is no grandfathering, it is punitive and retrospective, because property will already have been purchased as a part of existing structuring and cannot be easily moved around. A reduction in Land Tax is not always the primary driver when purchasing property in different entities (there are usually other concerns in play, such as asset protection) and the result of this change will be a significant additional tax bill.

The effect of this is that while the entities will still be assessed on Land Tax in their own right, property owners will now also have to include their beneficial share of that property as a part of their own personal Land Tax calculations. This is not the case though where it is held in a company (there are separate aggregation rules for companies) or a discretionary trust that has not made a nomination (below).

A credit is then available for the individual's amount paid in the other entity, so that the individual avoids double taxation. The result in many cases though is still a significantly higher bill because of the aggregation, because by aggregating, any additional property does not get the benefit of the lower thresholds again. The implications for some could well run into tens of thousands of dollars or more. In addition, in a situation where any credit exceeds the amount of Land Tax payable by the individual, no refund of the excess is available.

It's worth noting too that this also applies to joint property ownership, i.e. individuals owning property together, rather than through an entity. So for example where a couple owns a property, and then one of those partners separately owns another property, aggregation rules also apply.

The problem with trusts

There is a problem that arises with all this aggregation though, because sometimes the ultimate beneficial owner of a property held in a discretionary trust is difficult to determine - precisely because the distribution of income and assets is at the 'discretion' of the trustee. A simple way to avoid this would be for a trust to simply nominate each year who the beneficial owner(s) is (are). There is a risk here however that people would simply nominate the most tax effective individual each year. So taking a leaf from the Federal Government's playbook, the State Government has instead gone after trusts and put a sledgehammer to solving the problem.

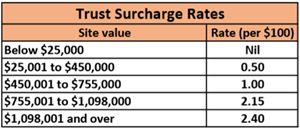

Surcharge rates will apply for trusts that hold eligible property in their own right, without a nominated individual beneficiary. Per the table below, the rates are $0.50 per $100 higher than the standard rates up to the top threshold, at which point the rate is the same. Significantly though, a trustee will pay Land Tax at a rate of $0.50 per $100 starting at $25,000! That's an extra $2,125 in Land Tax 'surcharge' over and above normal rates for a property valued at $450,000! On our property valued at $2 million, the amount of tax payable by a trust would come to $32,825.50 - a total premium of $6,673 over standard Land Tax rates.

This is clearly intended to be a disincentive for property owners to hold land in a trust. For discretionary trusts that already do, a once off nomination is available which allows the trust to declare an individual as a beneficial owner of existing land, in which case the trustee will not be assessed using the surcharge rates, but the value of the property will be aggregated with any other property owned by the individual for Land Tax purposes (refer 'Aggregation above, which brings potential problems of its own). Importantly, this nomination can only be made once, and must be made by 30th June 2021. And it cannot be changed except under extraordinary circumstances (say, where the nominated beneficiary dies), although it can be withdrawn. So a child (over 18 years of age) nominated as the beneficial owner today will be the same 'owner' for Land Tax purposes in 20 years' time when his or her circumstances may have changed sufficiently to make this nomination more punitive.

This option to nominate is not available for any future purchases of property in discretionary trusts, thereby rendering them less attractive as a vehicle for property ownership (though it does not necessarily preclude them entirely).

Unit trusts, because the beneficial ownership of the property is able to be determined in proportion with unit holdings, will have an option to decide whether the proportional interests of the beneficiaries should be notified, in which case their share would be aggregated with any other holdings for Land Tax purposes, or whether the Trust should be assessed at surcharge rates.

There is some significant work to be done here, for those who hold property in trusts, to determine the most tax effective approach, and some of this needs to be undertaken before the end of this financial year. Trustees will need to determine whether it is better to pay the surcharge or nominate beneficial owners, and if they decide on the latter, who the most appropriate beneficiary should be (which in turn will require some crystal-ball type guesswork). Trustees of unit trusts will not have to make this last determination, but will still have to give consideration as to whether it is better to pay the surcharge or nominate the beneficiaries to be taxed, who will then have other land holdings aggregated with their share.

For future acquisitions it may well be that it is still better overall to have the trustee taxed at surcharge rates and hold property in a discretionary trust in order to achieve more significant tax benefits and/or asset protection. This will need to be determined on a case-by-case basis, and is likely to add to the already significant cost of purchasing a property.

It's essential that if you currently own a property in your trust, you give consideration to the best outcome for your circumstances. Please contact us for assistance.

Our take

The word 'reform' is thrown about by Governments at all levels whenever significant changes to various taxes are proposed. In some cases, like the recent elimination of commercial Stamp Duty, the term is warranted, because the outcome is usually a more efficient, simplified process of compliance and also, hopefully, a reduction in the amount payable. It's increasingly being used, however, to describe changes that result in greater complexity, higher compliance costs and worse tax outcomes for taxpayers. See the latest Federal Government superannuation 'reforms' from a few years back as a prime example. These changes fall very much into that second category.

With the final result being a net loss to the State Budget bottom line, it's hard to see what the benefit is beyond a symbolic win and some ideological satisfaction. And ironically, it's more likely to be mid-range 'mum and dad' type investors who are hit worst of all, because corporate property holders may well have been subject to a form of aggregation already. They will benefit from the reduced rates of tax, while individual investors will find themselves hit with significantly higher Land Tax bills as a result of having to aggregate for the first time.

The one thing that is certain is that Land Tax has gone from a being a secondary tax planning consideration to being an essential component of any tax-effective property acquisition strategy.

As accountants we know that we're probably considered the Scrooge in the room every time we raise this. And if your motto this year is "Go big or go home", then read no further - you're likely not too worried about paying some extra tax. But if you're wanting to show your staff a little (less extravagant) love this Christmas, there are a few things worth keeping in mind to ensure you (or your employees) don't end up paying more tax than you need to.

As accountants we know that we're probably considered the Scrooge in the room every time we raise this. And if your motto this year is "Go big or go home", then read no further - you're likely not too worried about paying some extra tax. But if you're wanting to show your staff a little (less extravagant) love this Christmas, there are a few things worth keeping in mind to ensure you (or your employees) don't end up paying more tax than you need to.

Firstly, Christmas parties are considered to be entertainment and therefore not a deductible expense to the business. This also means you can't claim back the GST as well. The one exception is where the party is held off-site and the value per head is more than $300. In that case, you can claim the cost as a deduction and also claim back your GST, but the costs will also be liable to Fringe Benefits Tax (FBT). It's worth noting too that if you hold a party on premises where the cost per head is more than $300, and partners and associates of employees are invited, the same rules apply for that component of the cost that is attributable to the associates (but not the employees themselves). Deductible, but FBT payable. We know...it's never simple!

In terms of gifts for employees, your best bet is to give non-entertainment type presents that cost less than $300. These are fully tax deductible, the GST can be claimed and there is no FBT because they are considered to be minor and infrequent. The critical aspect of that however is that the gift must be non-entertainment. To some extent this can be quite arbitrary, but the Tax Office has issued some guidance on what is, and is not, considered to be 'entertainment'. Christmas hampers, flowers and other material gifts are not classed as entertainment, and neither are gift vouchers (unless they are for an 'entertainment' activity, such as going to the movies). Interestingly, bottles of wine and spirits are also non-entertainment. Tickets to sporting events, the theatre and the movies are all considered to be entertainment, as are flights and accommodation and club memberships. You can also give a gift of equal value to a partner of an employee, which may provide the opportunity to do more.

So in summary, you're mostly going to be out of luck getting a deduction for any Christmas party (and if you do you'll be up for FBT), but that's not the reason you do it of course. Just try to keep the cost per head under $300. And while we don't want to ruin the spirit of Christmas, the safest gift you can give your employees (and their partners) from a tax point of view (and can we say, often in how it is received too) is a voucher valued at under $300. Just make sure whatever you give that it is 'non-entertainment' in nature.

As always, if in doubt, please contact us.

All of us at Dewings would like to take this opportunity to wish you and your family a safe and happy Christmas and New Year.

All of us at Dewings would like to take this opportunity to wish you and your family a safe and happy Christmas and New Year.

We love our work and we're grateful for the privilege and opportunity you give us to be able to work with you. Thank you.

We're fortunate to have a fantastic team who work exceptionally hard during the year, often under a lot of pressure to balance a demanding workload and meet a variety of deadlines. So we like to take a bit of time off at this time of year to relax, unwind and spend time with family and friends before the new year ramps up in earnest again. We hope that you too find some time to refresh and revive.

Office hours

To that end, we'll be closing our office for a couple of weeks again as usual. While we often find that our clients want the same thing for themselves at this time, please do feel free to contact us if you need assistance with anything.

The office will be closed from 1pm Friday 20th December 2019, and will reopen again in the new year on Monday morning, 6th January 2020.

During this time you can still call and leave a message, and we'll ensure someone gets back to you as soon as possible. We'll also leave a mobile phone number on our voice mail so that you can contact someone immediately for more urgent matters. We'll be checking our emails and faxes, and documents can be left in the locked drop box on the west-facing wall next to reception. Please use our enquiries@dewings.com.au email address for anything that needs immediate attention.

Who we're supporting this year

As is our tradition, in lieu of Christmas cards this year we'll be making a donation to charity. This year we're supporting the Hutt St Centre. We're aware that the safety and comfort we take for granted is not always available for everyone, and Christmas especially can be a challenging time for those who find themselves without a place to live. The Hutt St Centre aims to end homelessness for every person who walks through their doors, with care and without judgement, and we think that's a pretty good mission.

Download PDF Newsletter

Download PDF Newsletter