February 2016 Newsletter

We're already two months into the new year, which is a little scary. A bit like current financial markets! In this issue we invite our friend David Leon from Morgan Stanley to take the helm. He gives us some thoughts on current market instability and Morgan Stanley's outlook for the rest of the year. We also take a look at what the Federal Government, and the Opposition, might have in mind for the future of negative gearing and superannuation.

In this edition...

Courtesy of Morgan Stanley

Renewed turmoil has seen global equities record their worst start to the year in at least 27 years. While there have been several contributors to the recent instability, including geopolitical tensions between Saudi Arabia and Iran, and worries about default rates in US high yield credit as energy companies face lower oil prices, the key catalyst appears to be a re-intensification of capital outflows from China and the weakness in its currency.

Renewed turmoil has seen global equities record their worst start to the year in at least 27 years. While there have been several contributors to the recent instability, including geopolitical tensions between Saudi Arabia and Iran, and worries about default rates in US high yield credit as energy companies face lower oil prices, the key catalyst appears to be a re-intensification of capital outflows from China and the weakness in its currency.

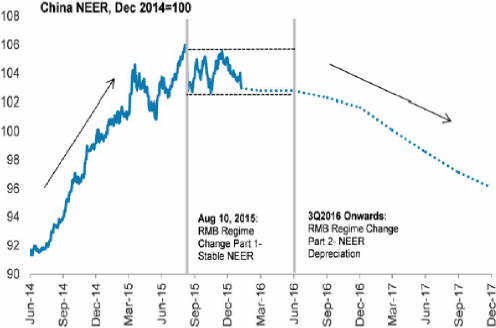

Markets were similarly unhinged in August last year when the People’s Bank of China announced the largest devaluation in the Yuan (CNY) against the US Dollar (USD) in two decades – depreciating it by 1.9% in one day. Since then, the PBOC has moved to manage the currency against a trade weighted basket, and kept it within a tight trading band (Figure 1).

Figure 1

However, recent fixings on the USDCNY have seen the nominal effective exchange rate (NEER, ie: to a basket of currencies) depreciate towards the bottom end of the band, raising fears of a further significant devaluation, with consequences for global growth and deflation.

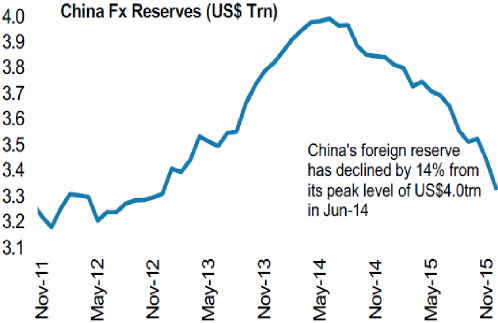

China’s latest difficulties stem from having to balance its policies on interest rates and exchange rates, against capital outflows. Put simply, since August 2015, China has focused on cutting interest rates to stimulate growth, a policy decision (when combined with rising rates in the US), that has seen capital outflows from the country accelerate, and in turn, placed downward pressure on the currency. China’s strategy has been to defend the currency within a tight trading band, causing it to run down its FX reserves at a substantial rate in the process. Between August to December 2015, capital outflows were estimated to total US$481bn and FX reserves declined by US$321billion – putting China’s FX reserves about 14% below its June 2014 peak (Figure 2).

Figure 2

Morgan Stanley’s Asian Macro team anticipates that China will persist over the next few months with maintaining a stable trade weighted FX regime, but at some point, it will have to choose between maintaining exchange rate stability or managing interest rates, or otherwise tighten capital controls.

In their view, policymakers would prefer to have control over interest rates, and hence, will move towards allowing more depreciation in the NEER from 3Q16, with risks if capital outflows persist at current rates, that this could happen sooner. As such, they are now forecasting the USDCNY to depreciate to 6.98 by year end 2016 and 7.31 by year end 2017 – essentially a 10% depreciation from today’s levels, by end-2017.

The implications of a weaker CNY, all else equal, is that it only acts to sustain growth in China (by avoiding the option of having to raise interest rates) but is negative for growth and inflation conditions elsewhere. A lower CNY puts upward pressure on some currencies such as the USD which essentially tightens financial conditions. Further, as China can now export at relatively cheaper prices, this allows them to regain export market share at the expense of the US, Europe and others. On the other side, key exporters to China (eg: Australia, Brazil) may suffer from poorer demand, given imports become more expensive for China.

Research sourced from:

“Research Scoop: 2016 – Choppy Waters” – Morgan Stanley Wealth Management Research, 15 January 2016

David Leon is a Certified Portfolio Manager® from Columbia University, New York, USA. David primarily advises family offices, medical and sports professionals. David holds the position of Executive Director with Morgan Stanley in Adelaide.

This communication is made by Morgan Stanley Wealth Management Australia Pty Ltd (“Morgan Stanley Wealth Management”) (ABN 19 009 145 555, AFSL 240813) and Participant of ASX Group. This communication is not a research report but may refer to research produced by Morgan Stanley Wealth Management and/or its affiliates (the “Firm”) or include the views of a Morgan Stanley Wealth Management research analyst. We are not commenting on the fundamentals of any companies mentioned. Unless indicated, all views expressed herein are the views of the author and may differ from or conflict with those of the Morgan Stanley Wealth Management Research Division or others in the Firm.

This communication provides market commentary and strategy ideas to clients of the Firm. Such commentary and ideas are based upon generally available information. Although the information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, and such information may be incomplete or condensed. All opinions and estimates included in this document constitute our judgment as of this date and are subject to change without notice. This communication and its contents are proprietary information and products of Morgan Stanley Wealth Management and may not be reproduced or otherwise disseminated in whole or in part without our written consent unless required by law.

This communication is not intended as an offer or solicitation in relation to any particular financial product. This material does not purport to identify the nature of the specific market or other risks associated with a particular transaction and may contain general advice. General advice is prepared without taking account your objectives, financial situation or needs and because of this, you should, before acting on the general advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs and if the advice relates to the acquisition of a particular financial product for which a Product Disclosure Statement (PDS) is available, you should obtain the PDS relating to the particular product and consider it before making any decision whether to acquire the product.

© Morgan Stanley Wealth Management Australia Pty Ltd 2016.

Labor recently upped the ante in the tax reform discussion by putting negative gearing in the spotlight.

Labor recently upped the ante in the tax reform discussion by putting negative gearing in the spotlight.

In a speech to the NSW ALP conference, opposition leader Bill Shorten announced that if elected, Labor would limit the availability of negative gearing to newly constructed homes. The measure would take effect from 1st July 2017. Arrangements in place before that date would be unaffected by the change, so the effect would be a 'grandfathering' where the measure becomes increasingly less applicable over time.

In addition, the current Capital Gains Tax discount of 50% on the sale of investment property available to individual taxpayers would be reduced to 25%.

The Government responded by criticising the plan, however did hint that changes to negative gearing rules were not out of the question. For better or worse, this is consistent with the Government's current pattern of talking up tax reform while offering very little in the way of details.

Negative gearing and its impact on the Australian economy, housing market and Federal budget is a complex issue. While it is true that it is a measure that is accessed by many medium-income investors, it is also true that the greatest financial benefit is derived by those with greater wealth. Complicating the issue is conflicting opinions on the effect that any changes would have on both housing availability and affordability.

One thing appears certain, however - change is coming. Watch this space.

The Federal Treasurer Scott Morrison recently spoke at the SMSF National Conference here in Adelaide, and used the opportunity to hint at the possibility of more changes to the Superannuation system.

The Federal Treasurer Scott Morrison recently spoke at the SMSF National Conference here in Adelaide, and used the opportunity to hint at the possibility of more changes to the Superannuation system.

Usually any changes will be proposed as measures to address the fairness of the system, and this was essentially the message of the Treasurer this time around as well. Stability will come, after some inefficiencies have been addressed. But as we predicted the last time a Government promised that the Superannuation system would be left alone in the name of certainty (less than 12 months ago), stability is an impossible dream.

The Government faces a difficult road ahead in its stated endeavours to balance the Budget. But the total pool of funds under investment in Australian superannuation runs into the many trillions of dollars, and for the most part it is all being concessionally taxed. So it's inevitable that Superannuation will present too tempting an opportunity for a quick fix.

Mr Morrison cited a Murray Report statistic that more than half of the benefits of Superannuation concessions go to the wealthiest 20% of Australians. But unlike the Federal Opposition's proposal for addressing this imbalance, he did seem to rule out any changes to the tax free status of Superannuation in the retirement phase. This would suggest that any reduction in these concessions, or attempts to make the benefit more equitable, would come in the accumulation phase, i.e. before retirement. He also highlighted that Superannuation was never intended to be used as an estate planning tool, to accumulate wealth at the expense of the taxpayer which is then passed on to children, which might suggest possible changes to non-concessional contributions limits.

Other potential changes include further improvements to Superannuation choices for workers, and addressing the lower level of Superannuation savings for those who must take time out from the workforce during their working life, in particular women with children and primary caregivers.

Unfortunately, aside from those last measures, it all adds up to more uncertainty in the Superannuation sector, especially with the ongoing lack of any detail. With difficult fiscal times ahead, we don't see this level of uncertainty changing much in the years to come.

Download PDF Newsletter

Download PDF Newsletter