August 2013 Newsletter

In this issue, we get a little fired up about the state of the economy and the proposed $2,000 limit on claiming self-education expenses - which has thankfully been deferred for another two years.

Plus we highlight another Dewings client success story and report from our time in Brisbane last month with ODMA.

In this edition...

-

The Federal Government mini-budget

-

Scrap the cap: opposition to the $2,000 self-education deduction limit results in a deferral until 1st July 2015

-

Adrian Evans awarded Sir James Irwin President's Medal

-

Dewings at ODMA 2013

The Federal Government mini-budget

The Federal Treasurer and the Minister for Finance and Deregulation released an Economic Statement on 3rd August 2013.

The Federal Treasurer and the Minister for Finance and Deregulation released an Economic Statement on 3rd August 2013.

Dubbed a 'mini-budget' by some, the Economic Statement is a response to what Treasurer Bowen described as "an economic transition - not a crisis", brought about by the apparent ending of the Chinese mining investment boom and a slowing of Chinese economic growth. The result of these factors has been a significant increase in the current budget deficit since the 2013-14 Federal Budget was handed down only a few months ago.

There were a number of tax measures in the statement, including:

-

A 12.5% increase in tobacco excise starting on 1st December 2013, with further 12.5% increases to follow on 1st September 2014, 2015 and 2016;.

-

Changes to the Fringe Benefits Tax (FBT) treatment of motor vehicles to align the calculation method more closely to actual business use (announced previously);

-

The removal of the 'in-house' FBT exemption for benefits that are salary sacrificed;

-

The introduction of a levy on bank accounts from 1st July 2016 to cover the Government protection of deposits;

-

An increase in the threshold below which the superannuation accounts of inactive and uncontactable members should be transferred to the Government, from $2,000 to $4,000 initially, before increasing again to $6,000 from 31st December 2016.

The Federal Government will also allocate more money to chase unpaid tax and superannuation amounts. Other previously announced measures were also affirmed, including the termination of the Carbon Tax, to be replaced by a full emissions trading scheme.

In a piece of welcome news, the previously announced cap of $2,000 for claiming self-education expenses was deferred until 1st July 2015 to allow more time for consultation. More on that below.

What does this all mean? In our view, this statement is really more of a pre-election spruiking of the Government's economic credentials and track record.

The Australian economy is facing some very significant challenges in the coming years, not least of which are the changes affecting our largest trading partner, China, which flow through to affect our own economic fortunes. With an election looming however, the Government appears reticent to implement any tough fiscal restraint measures. Furthermore, successive Governments, including this one, continue to talk about cutting red tape for business and reforming the taxation system, while doing little more than tinkering around the edges. The Institute of Chartered Accountants recently estimated that the average annual cost for each small business to comply with their tax obligations is $32,389. Cutting these costs to business has the potential to redistribute income back into the economy, which in turn stimulates growth.

Difficult economic times call for bold initiatives and historic action. At this point, this economic statement is more about treading water, and does little to stimulate confidence. It seems that we will have to wait until after the election to see policy initiatives that could make any real difference.

Scrap the cap: opposition to the $2,000 self-education deduction limit results in a deferral until 1st July 2015

Our lead article this time was going to be all about the proposed $2,000 cap on deducting self-education expenses, and what a terrible idea it was. Thankfully though, the Federal Government's recent 'mini-budget' included a deferral of this plan until July 2015 to allow for further discussion and industry consultation.

Our lead article this time was going to be all about the proposed $2,000 cap on deducting self-education expenses, and what a terrible idea it was. Thankfully though, the Federal Government's recent 'mini-budget' included a deferral of this plan until July 2015 to allow for further discussion and industry consultation.

We don't tend to editorialise all that much, but this is a measure that had 'bad policy' written all over it from the very beginning. Ostensibly the rationale behind the measure was that too many wealthy executives, doctors and other professionals were claiming the cost of first class airfares, luxury resorts and other big ticket items for attending international conferences, effectively subsidising junkets at the public expense. In reality it was an ill-conceived tax grab.

Costs incurred for self-education have traditionally been tax deductible to the extent they are related to a person's income earning activities. There has always been a specific limitation put on claims whereby the first $250 of any self-education claim was not deductible, but aside from this the logic behind being able to claim self-education expenses makes sense. It's an expense incurred in earning assessable income.

Self-education expenses have always been defined as costs associated with gaining a formal qualification from a school, university or other place of education. The government had indicated prior to the 2013-14 Federal Budget announcement that it planned to introduce a $2,000 cap on claims for self-education expenses, so confirmation of the measure hardly came as a surprise. But in a press release that accompanied the Budget announcement, it was suggested that the $2,000 cap would be extended to costs associated with conferences, seminars and self-organised study tours. These are costs which potentially may have never been included as 'self-education' expenses previously. They would ordinarily have been claimed simply as work related deductions, without the need to apply the $250 cap. Not only was the government now limiting claims for self-education expenses, but they were also redefining the general understanding of the term.

The response was dramatic. As a sample, the President of the Australian Medical Association (AMA), Dr Steve Hambleton, said that the Treasury Discussion Paper shows a total lack of understanding of the reality of professional self-education, especially for doctors. Universities Australia predicted that "postgraduate full fee student numbers could drop by up to 30 per cent in just four years and Australia's national productivity could fall by at least $2.8 billion annually if the Government goes ahead with its proposal to tax education." In a 'Response to Treasury' discussion paper, the Australian College of Optometrists said that "professional education will be affected by the amount that can be claimed on tax, risking that clinicians choose activities based on cost rather than pursuing excellence of education that addresses individual learning needs, explores innovative concepts and teaches new theory. Ultimately health outcomes for patients will be impacted."

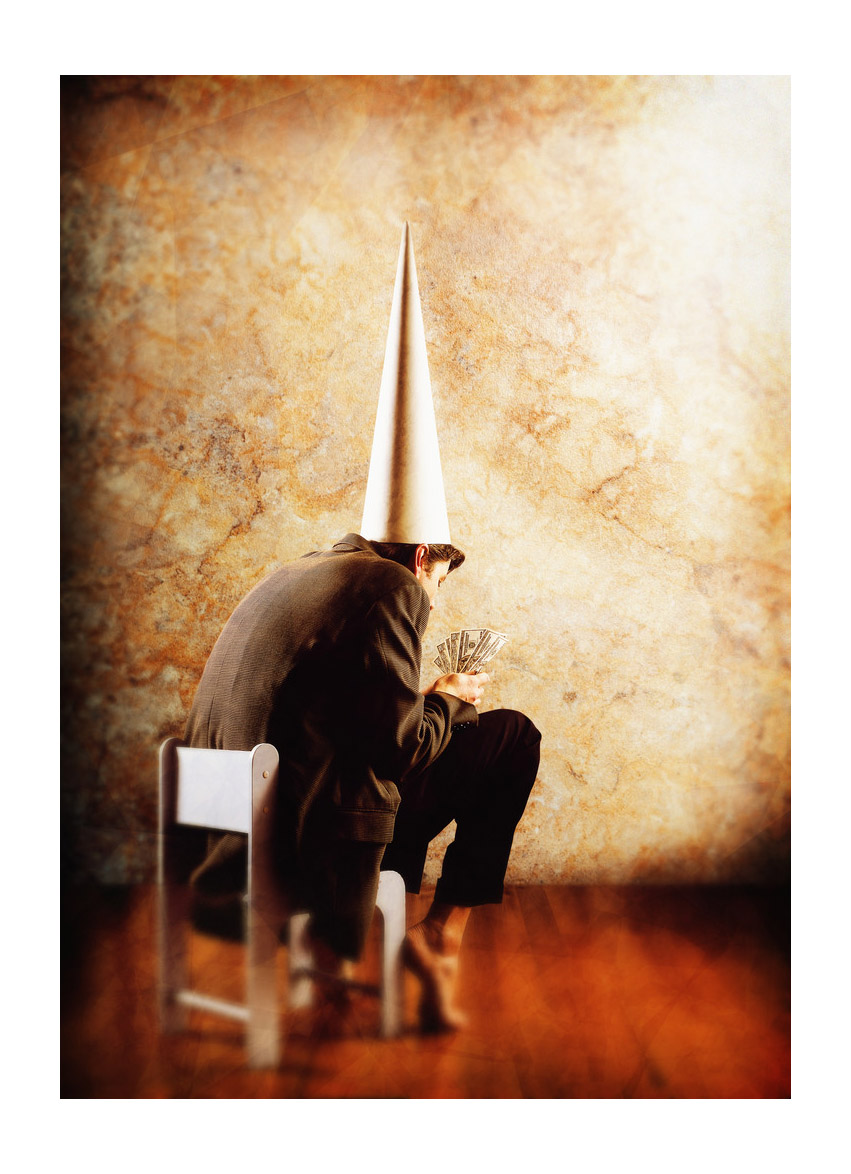

In short, representative bodies across a wide range of industries came out in almost unanimous opposition. A significant number of them aligned under the banner of #ScraptheCap to push for a reversal of the initiative. The Tax Institute of Australia perhaps expressed it best when they said "Government earns dunce’s cap with tax hike on learning".

Fortunately, the Government seems to have listened. The announced deferral may simply be a pre-election ruse to turn down the heat for a while and if implemented in its current form, this will be as bad a policy in 2015 as it would have been in 2014. Nevertheless, we join with others in calling on the Federal Government to take this opportunity for a more considered approach. The voice of opposition to this proposal is widespread, and alternative measures should be explored which prevent exploitation without penalising those legitimately seeking to further their education by funding it themselves.

Adrian Evans awarded Sir James Irwin President's Medal

We love to see our clients succeeding in business, and it's even better when they are formally recognised for their achievements.

We love to see our clients succeeding in business, and it's even better when they are formally recognised for their achievements.

Recently Adrian Evans, Director of JPE Design Studio and a long-standing Dewings client, was awarded the Sir James Irwin President's Medal by the SA chapter of the Australian Institute of Architects. This award celebrates the work of an architect who has made a significant contribution to design and architecture in South Australia.

Adrian has been responsible over a number of years for many significant South Australian building projects, including the Santos Athletics Stadium, the Adelaide Entertainment Centre and the Adelaide College of the Arts on Light Square. In recent years his work with JPE Design Studio has included the Margaret Tobin Mental Health Centre at Flinders University and the Wave and Edge Office and Apartments Development at the southern end of King William Street.

Congratulations to Adrian on your success and for this award, and thank you giving us the opportunity to work with you.

Dewings at ODMA 2013

Dewings directors Kathy Allen and John Manning, together with senior manager Michael Denholm, were in Brisbane at the beginning of July to present at ODMA 2013.

Dewings directors Kathy Allen and John Manning, together with senior manager Michael Denholm, were in Brisbane at the beginning of July to present at ODMA 2013.

ODMA 2013 is the premier showcase event for the latest products and services available to the optical industry.

In addition to trade displays and product launches, a series of professional development workshops are presented, and we were invited to demonstrate the financial model we have co-developed with ODMA (the Optical Distributors and Manufacturers Association). This model helps practitioners in the eye-care industry analyse the many different financial elements that work together in their businesses to deliver the end result. They can use it to test a wide variety of business scenarios to see what impact they will have on the bottom line. This may include changes in consulting and sales volumes, the effect of discounting, planning for retirement and many other common strategies in the lifecycle of a practice.

We had a great time both professionally and socially and we're grateful to ODMA for the opportunity to develop and present this model with them. You can view a demonstration of the ODMA model here. If you work in the eye-care industry, it's well worth checking out and if you're in independent practice, your initial consultation with us and the model itself will be complimentary.

Even if you're not involved in eye-care though, financial modelling is a valuable tool for any business. If you'd like us to work with you to adapt a model for your business, please contact us.

Download PDF Newsletter

Download PDF Newsletter