2024-25 Federal Budget

The 2024-25 Federal Budget has been handed down by Treasurer Jim Chalmers. While recent Budgets have tended to focus more on spending and cost-of-living relief than tax measures, it's no understatement to say that this year there is almost nothing to report from a tax and business perspective. In fact, the only significant reference to tax in the Treasurer's Budget speech was in relation to the amended Stage 3 personal income tax cuts, which were already legislated. Some of our industry bodies have, for the first time in our memory, gone so far as to cancel their traditional post-Budget briefing functions, so little content is there to cover. As such, our annual summary of Budget highlights will be brief.

The 2024-25 Federal Budget has been handed down by Treasurer Jim Chalmers. While recent Budgets have tended to focus more on spending and cost-of-living relief than tax measures, it's no understatement to say that this year there is almost nothing to report from a tax and business perspective. In fact, the only significant reference to tax in the Treasurer's Budget speech was in relation to the amended Stage 3 personal income tax cuts, which were already legislated. Some of our industry bodies have, for the first time in our memory, gone so far as to cancel their traditional post-Budget briefing functions, so little content is there to cover. As such, our annual summary of Budget highlights will be brief.

Business

Small business instant asset write-off extended (again) - The way the law currently stands, small businesses with annual turnover of less than $10 million can write off assets costing less than $1,000 in full in the year of purchase, rather than depreciating them over their useful life. As we noted in last year's Budget summary however, the actual limit has not been set this low for years. Keeping it above $1,000 requires an annual amendment though. The proposed level for 2023-24 was $20,000, which was later increased to $30,000 by Senate amendment, but the legislation to confirm this has yet to pass through Parliament, and the window to do so closes on 30th June. In our view the Government must dispense with this ongoing uncertainty and permanently legislate the higher threshold. Last night’s Budget proposes to set the threshold at $20,000 for the 2025 tax year.

We also reiterate our usual caveat here that there is no real tax benefit to this measure. It simply brings forward successive deductions from future years into a single current year. As such the benefit is one of cash flow only, and is therefore only advantageous for profitable businesses in reducing their current year tax liability.

Energy bill relief - This announcement is light on detail at the moment, but ostensibly will provide a $325 rebate for small businesses to help cover rising electricity costs. We see this measure more as an election sweetener. While any relief is welcome, it's hardly going to make a difference for those small businesses that are drowning under the tide of rising input costs.

Personal

Amended Stage 3 tax cuts - The big-ticket item from this Budget is the amended Stage 3 personal income tax cuts. These have already been announced and legislated, but are worth recapping here.

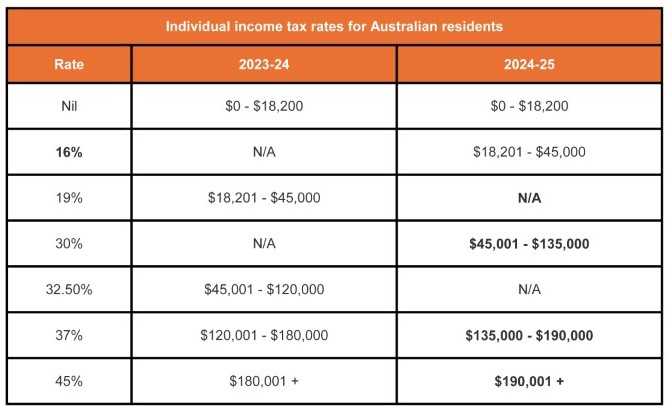

The new rates for 2024-25 onwards, when compared to the current year rates, are as follows:

The saving for most taxpayers will be significant. For someone earning $50,000 a year, the annual saving will be $929. At $100,000 per annum it will be $2,179, while the maximum saving will be for those earning $200,000+ per year at $4,529. This should be a welcome correction for many to the problem of bracket creep, where income increases over time but tax brackets remain unchanged.

Change to HECS/HELP indexation rate - As previously announced, the annual indexation rate applied to outstanding HECS/HELP debts will be changed to be the lower of the Consumer Price Index (CPI) and the Wage Price Index (WPI). After a CPI-driven increase last year of over 7%, the Government moved to make this change to reduce the indexation burden. The amendment is backdated to 1st June 2023, which will reverse much of last year's pain by applying the much lower WPI rate of 3.2%.

Our take...

Unsurprisingly, there is very little here for us to get excited about. In what is becoming an all too familiar pattern in recent years, this is a Budget which lacks courage and vision. Aside from minor investments in the green economy and some hyper-specific industry incentives, there is no broad-based focus on the future or the structure and inefficiencies of the current tax system, or even on providing genuine short-term relief from the numerous headwinds facing those in business. It remains to be seen whether there is enough here to give the Government a sought-after boost at the next election, but it seems clear that the intention is for it to do little else.

Download PDF Newsletter

Download PDF Newsletter